Tantalum, a rare and highly sought-after mineral critical to modern electronics, including modern military equipment in Russia, derives its name from Tantalus, a tragic figure in Ancient Greek mythology. According to legend, Tantalus was condemned by the gods to suffer an agonizing punishment: standing in a pool of water beneath a tree laden with fruit, he was eternally tormented by thirst and hunger. Whenever he reached for the fruit, the branches would retreat, and whenever he bent down to drink, the water would recede beyond his grasp.

This myth could serve as an apt metaphor for Russia’s pursuit of tantalum to fuel its military industrial complex - a resource that should remain out of reach. Unfortunately, reality diverges from allegory. Despite its rarity and the serious problems caused by sanctions, tantalum still finds its way into Russia, sustaining its military production lines for missiles, tanks, UAVs, communication devices, and more.

Contents

Intro

I. Shortages and Production

II. Tantalum Imports and Sanctions

a) Mineral Imports

b) Capacitor Imports

Required Actions and Summary

Russia relies on tantalum to produce tantalum powder, an essential component for capacitors used in electronics, particularly in control, navigation, and signal processing systems. The largest tantalum mining countries include the Democratic Republic of Congo (DRC), Rwanda, Brazil, Nigeria, and China. While Russia has its own tantalum deposits, they are significantly smaller - mine production in Russia is nearly 50 times less than that of the DRC. However, extraction is only part of the problem. Russia lacks advanced processing facilities to produce high-quality tantalum powder needed for capacitors.

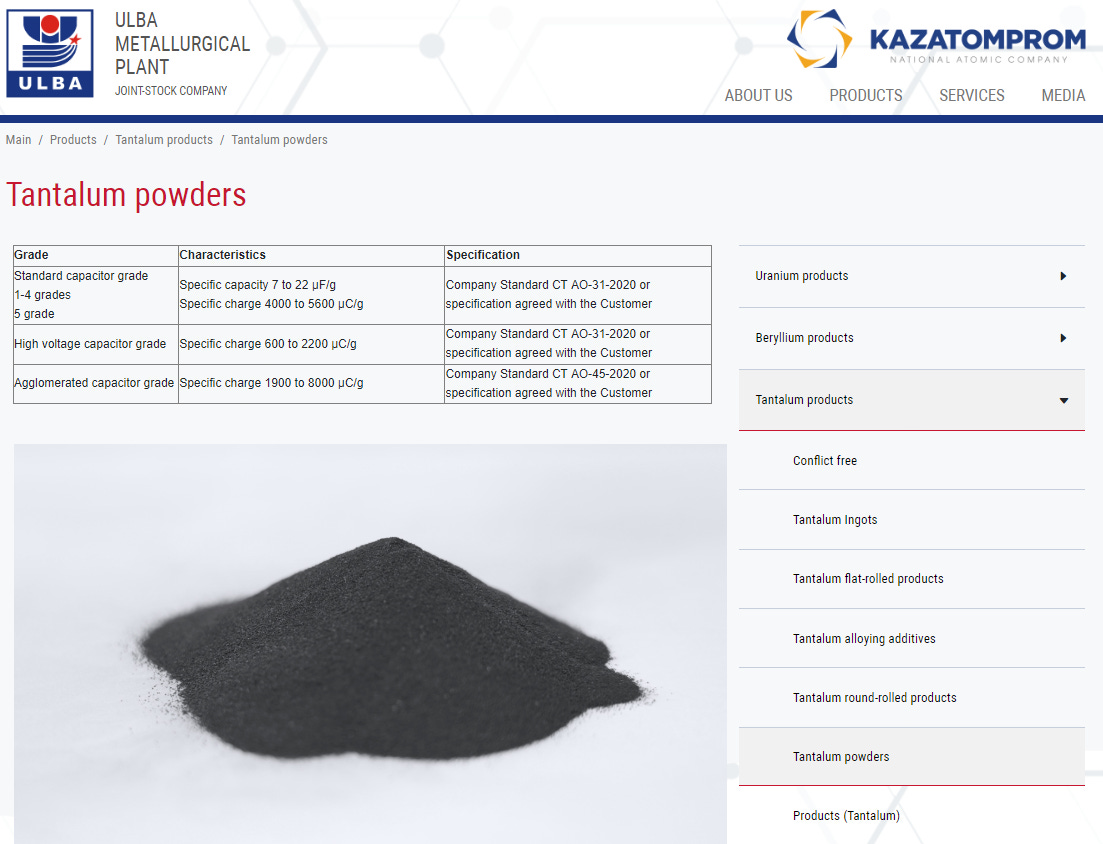

Historically, tantalum processing has been conducted at the Ulba Metallurgical Plant in Kazakhstan, a facility built during the Soviet era. When sanctions were implemented, Kazakhstan joined them, cutting off Russia’s primary supply of processed tantalum.

Now lacking a processing facility to convert raw tantalum into the powder used for capacitors, coupled with the ever-increasing demand from military production, Russia has been forced to seek alternative solutions to sustain output

I. Shortages and Production

Tantalum capacitors, known for their small size and high capacitance, are integral to a wide range of military products. They have been found in UAVs like the Corsair, Shahed-136, and Mohajer-6, the Supercam S-150, various radio systems such as the R-168 and R-392, the Sagittarius-M intelligence control and communications complex, T-72B3 tanks, X-47M2 Kinzhal and Kh-59MK2 missiles, the 9M727-K Iskander missile, the R-77 missile, and even North Korea's KN-23/24 ballistic missiles. This list gives us a good idea of what is currently impacted, and what could be further affected by sanctions targeting tantalum and its derivatives, such as capacitors.

Our trusted sources in Russia provided a more detailed picture of the ongoing shortages and their impact on production. For example, Novosibirsk Radio Components Plant "Oxide" and the Girikond Research Institute - both involved in tantalum capacitor manufacturing, are grappling with critical raw material deficits, reportedly as high as 50%. This translates to a shortfall of over two tons of tantalum essential for weapons production, with no immediate solutions for procurement.

Constrained by sanctions and their limited domestic processing capabilities, Russian authorities are exploring alternative ways to sustain production and circumvent restrictions. These efforts essentially boil down to two basic approaches: importing dual-use tantalum capacitors directly or acquiring processed tantalum to support domestic production.

Both options, however, face significant obstacles. The imposed sanctions complicate direct imports, while the lack of advanced processing facilities makes local production equally problematic. For Russia, avoiding the collapse of multiple state military hinges on their ability to resolve these shortages

II. Tantalum Imports and Sanctions

a) Mineral Imports

An investigation by The Insider revealed that it wasn’t until late 2023 that Russia’s Ministry of Industry and Trade began to address the need for domestic tantalum powder production, allocating 270 million rubles for research. This confirms that, up until that point, Russia was likely unable to meet its tantalum demands and was actively seeking ways to scale its domestic production capabilities.

Given these shortages, Russia tried relied on external sources, with China becoming one of its primary alternative suppliers of tantalum. According to official trade data, in 2021, Russia imported $1.4 million worth of tantalum from China, equivalent to approximately five tons depending on market prices. By 2023, this figure had soared to $13.3 million. However, our internal sources report that much of the tantalum acquired from China in the past failed to meet the required quality standards during testing, leading to delays and setbacks in fulfilling defense contracts.

Furthermore, Russia’s defense-industrial complex faces a substantial monthly demand for processed tantalum, estimated at 800 kilograms. Current requirements for existing contracts exceed 4.5 tons, while available reserves stand at just 2.2 tons. With such a deficit, Russia cannot rely on domestic production alone to meet its needs.

This shortfall leaves Russia with one remaining option: importing tantalum capacitors directly instead of producing them domestically.

b) Capacitor Imports

According to a previously mentioned investigation by The Insider, Russian state enterprises - including subsidiaries of Rosatom, state research institutes, and even an FSB unit have sourced capacitors from the Japanese-American company Kyocera AVX as recently as 2024.

The Worldbank data shows that in 2021, a significant number of capacitors exported to Russia originated from El Salvador, which became on of the leaders in capacitor exports thanks to Kyocera AVX production in the country.

However, in the wake of sanctions, there have been some changes since 2022. The majority of tantalum capacitors imported into Russia are now routed through China. According to the Insider investigation, customs records often list these capacitors as Chinese exports, yet many bear markings indicating they were manufactured in El Salvador.

A quick search for tantalum capacitors on the popular Chinese online retail platform AliExpress reveals no apparent shortage of options available for delivery to Russia. Many listings include detailed descriptions, with several already written in Russian, indicating a clear focus on catering to Russian buyers.

It remains unclear whether such capacitors meet the required standards or if their use could result in critical system failures, such as deviations from intended trajectories, premature detonations, or launch malfunctions.

Chinese and Kyocera AVX are not the sole supplier of tantalum capacitors to Russia. Products from other major manufacturers, such as Vishay and Kemet, have also been implicated. According to The Insider, Russia imported at least $6 million worth of Kemet tantalum capacitors in 2023. However, this does not imply that these companies are directly complicit in selling to Russia.

These capacitors, manufactured by Kemet in Mexico, were first shipped from Hong Kong to Hungary. From there, they entered Russia via a third-party trading company, Matrix Metal Group Kft.

Required Actions and Summary

Our investigation shows that sanctions, while imperfect, are actually working. Discussions about rare metals like tantalum and their products, such as tantalum capacitors, may not captivate public attention as much as the seizure of oligarchs’ yachts or billions of frozen assets. Yet, laser-focus sanctions can lead to significant disruptions in military production.

It is true that it is not feasible to block every dual-use item from reaching Russia in such ever-evolving networks designed to bypass sanctions. However, it is possible to continuously increase the costs of circumvention. Raising the financial, logistical, and temporal costs for Russia has a direct impact on its ability to fulfill state military contracts.

For example, businesses and companies involved in the production or trade of tantalum powder or capacitors, especially those operating out of China, must face the prospect of losing access to Western markets if detected trading with Russia. The same principle should be applied to their parent companies of sanctioned subsidiaries, ensuring that corporations cannot simply establish temporary entities designed to be dissolved when sanctioned, only to replace them with new ones the next day.

The idea is simple: this cycle will persist unless the risks are severe enough to outweigh any potential gains. After all, sanctioning and tracking a rare product that disrupts entire production chains across multiple military domains could be a more effective way to counter Russia.

Superb article, thank you.

🤔 I thought they were using the chips from washing machines🙄