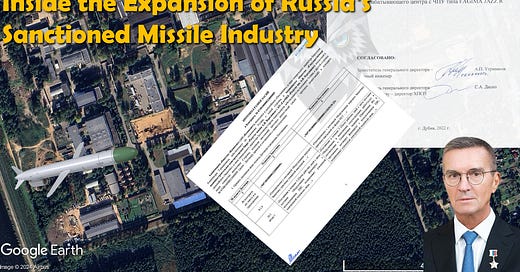

Special Report: Inside the Expansion of Russia's Sanctioned Missile Industry

Raduga Design Bureau

An investigation by Frontelligence Insight reveals that since 2022, despite sanctions, the Russian state design bureau Raduga, integral to the production cycle of cruise missiles, has not only continued to operate but has also expanded its production capabilities, thanks to imported Western and Chinese machinery.

Raduga is a design bureau located in Dubna, Moscow Oblast, specializing in the production of various missile systems, primarily airborne cruise missiles, frequently used to target sites in Ukraine. This includes modifications of the Kh-55, Kh-59, Kh-69, and Kh-101 missiles, among other types. Based on available satellite imagery, the facility has been undergoing constant expansion since pre-war times and continues to do so during the war. According to 2023 imagery, new facilities were under construction, which is consistent with documents from Raduga in our possession.

The project documentation obtained from the Design Bureau "Raduga" provides further insights into the construction plans. According to the outlined schedule, two new production facilities, namely M11A and M11B, are planned to be completed by April 2024. Moreover, other documents reveal that these facilities will be equipped with foreign-made machinery tailored for industrial-scale production.

The Raduga State Machine Building Design Bureau was sanctioned by the U.S. Treasury on March 24, 2022. These sanctions aimed to disrupt the production of high-precision missiles, which relies on Western and non-Western machinery. However, leaked documents obtained by Frontelligence Insight from Ukrainian Cyber Resistance reveal that despite sanctions, Raduga not only continued to operate but also underwent modernization and expansion, opening new depots. The documents show that Raduga managed to acquire the necessary machinery from Europe and China

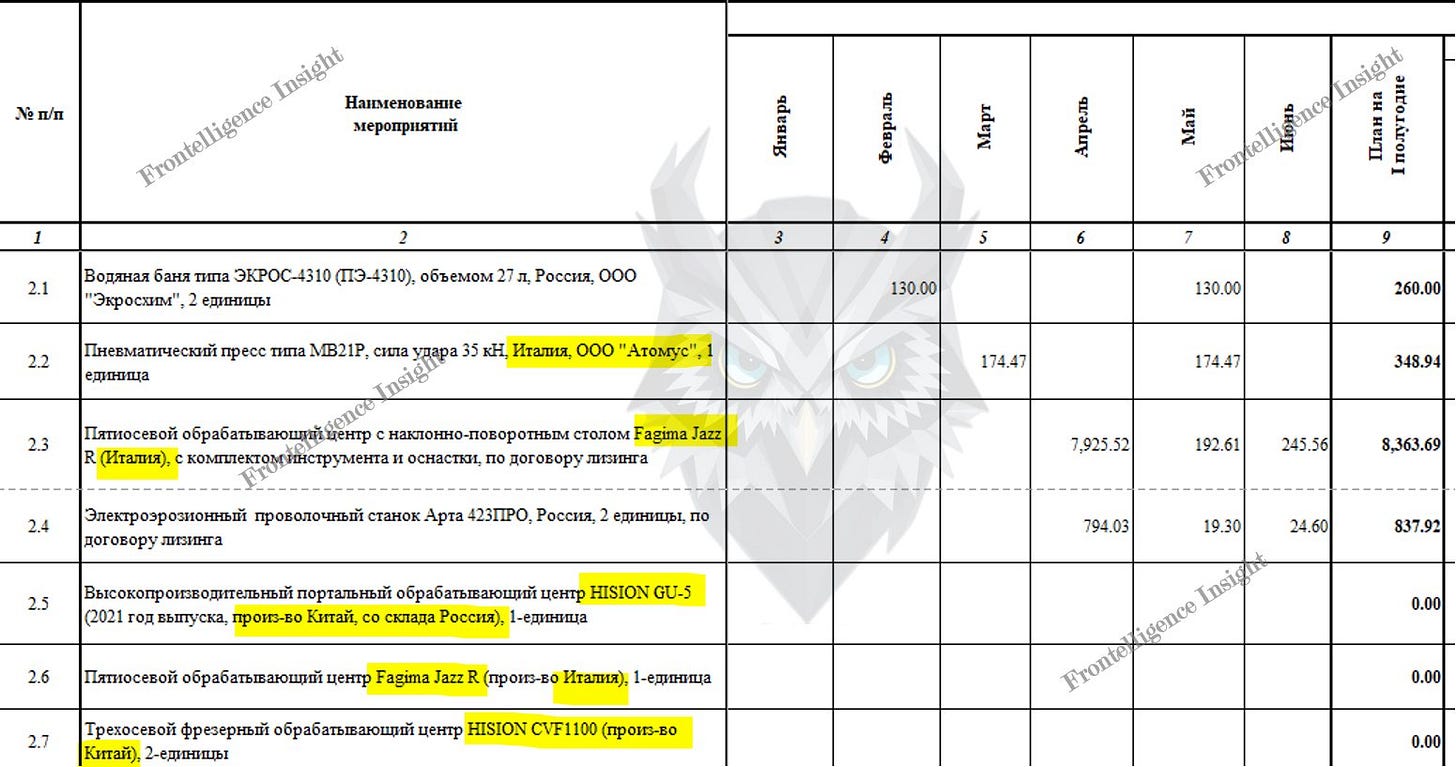

Raduga's Plan for Technical Modernization and Reconstruction for 2023 offers a detailed overview of the requirements, costs, and goals set by the enterprise to meet the production volumes needed by the Ministry of Defense. The plan reveals that new production sections were to be opened in buildings M10, M11A, and M11B.

To organize additive manufacturing via selective laser sintering, the Russian Ministry of Industry and Trade granted permission in October 2022 to acquire a "foreign manufacturing product," specifically the FS421M.

The FS421M is an additive metal melting system (laser sintering) designed for industrial-scale production. This equipment is produced by Farsoon, a company based in Hunan, China.

Raduga's Plan for Technical Modernization and Reconstruction also included a budget and a list of specific equipment, along with their countries of origin. The following non-Russian companies were listed: Fagima Jazz R (Italy), Automator (Italy), Hottinger GmbH (Germany), Hangcha (China), and Hision (China).

It remains unclear whether this equipment was purchased through third parties or third countries. However, in some cases, such as with the Italian company FAGIMA FRESATRICI SRL, business communication was likely conducted directly. Given that this equipment is used in large-scale manufacturing and not regular consumer products, it's uncertain whether these companies conduct sufficient due diligence or trade with a degree of plausible deniability if caught.

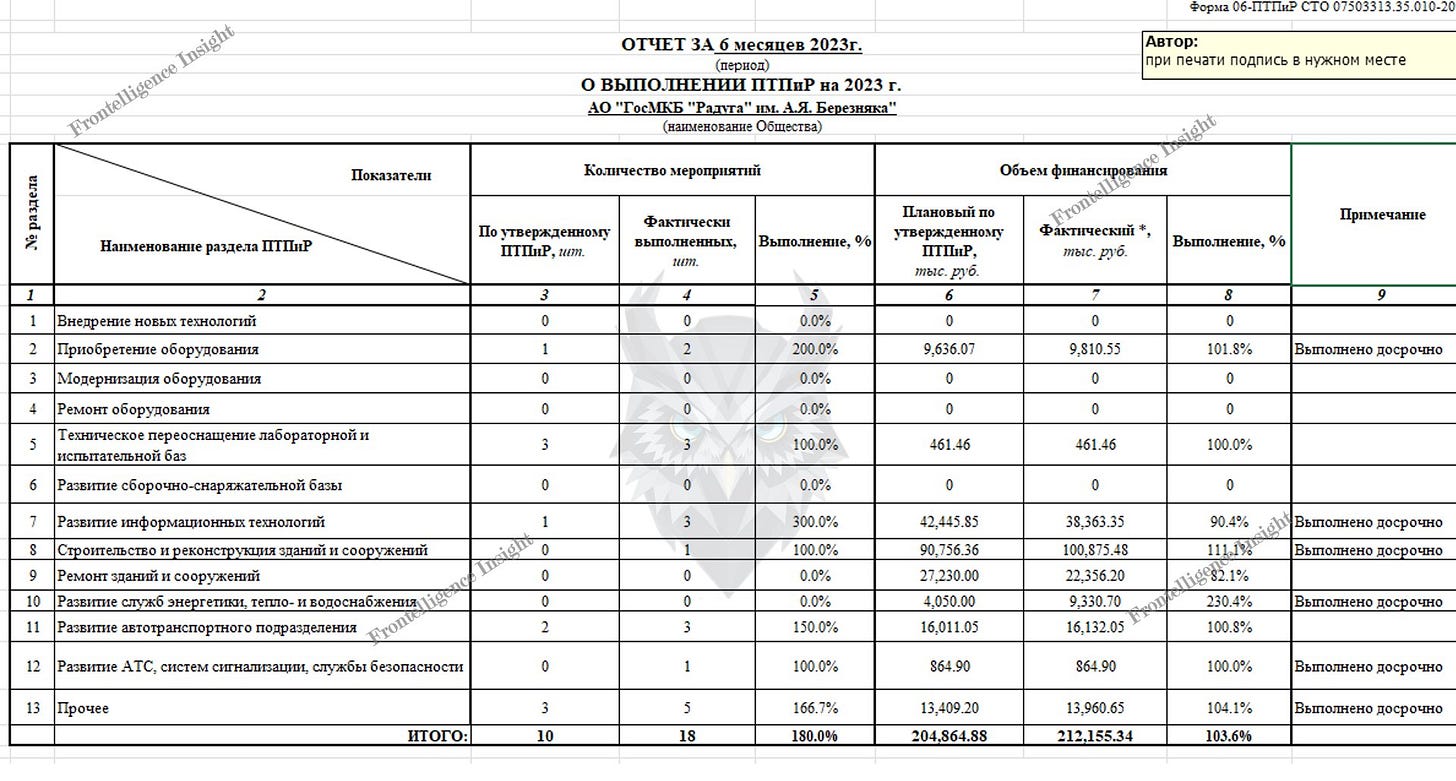

One of the questions, of course, is whether Russia was successful in purchasing this equipment. The answer lies in the semi-annual report on task progress, which tracks the completion of tasks outlined in the modernization plan. According to this report, most of the planned tasks for the first half of the year were completed on time, with some even ahead of schedule. This suggests that some of the listed equipment has already been successfully purchased and potentially delivered.

The document also details the allocation of finances. The majority of finances were allocated to the procurement of new equipment, the construction and modernization of buildings, the development of the cars department, the enhancement of laboratory and testing facilities, and the development of IT solutions.

In summary, despite facing sanctions, the design bureau continued its operations and expansion efforts to meet the increased quotas set by the Ministry of Defense. Design Bureau "Raduga" managed to procure industrial equipment from China, a predictable move, but also maintained collaborations with European firms, specifically those from Italy and Germany. This raises doubts about the efficacy of sanctions when not rigorously enforced and calls into question the existence of adequate enforcement mechanisms. This also shows the dependence of the Russian military industry on Western technologies and equipment, a dependency that European governments could potentially address with stricter enforcement.

The original files are accessible to our paid subscribers via the following link: